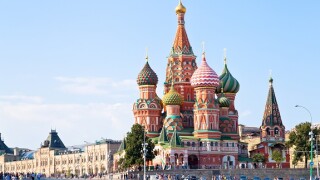

Russia

-

Segezha, the Russian paper and pulp company, has completed its IPO on the Moscow exchange. The conclusion of the listing was a relief for the company, given fears that it could have been derailed by political tensions between Russia and the US.

-

A wave of Russian equity capital markets activity has broken this week, taking advantage of a rise in optimism that geopolitical tensions between Russia and the US are decreasing.

-

Russian paper and pulp company Segezha is covered across its initial price range in its IPO, showing that Russian companies can withstand political volatility when doing an IPO.

-

-

Emerging markets bond buyers and issuers are regaining confidence as US Treasury volatility falls, with issuance in CEEMEA and Latin America having picked up in recent days and a pipeline building.

-

Segezha, the Russian paper and pulp company, has set a price range on its IPO despite the growing pressure faced by Russian companies as hostility between the country and the US increases.

-

Russian steelmaker Metalloinvest has secured a $350m credit line from international lenders. Metalloinvest is the second Russian corporate to tap international lenders since fresh sanctions were announced against Russia by the United States.

-

Etalon, the Russian real estate and construction company listed in London, has launched a rights issue to help fund its investment in new land and development.

-

Sovcomflot, the majority state-owned Russian shipping company, defied some market participants' expectations on Tuesday by coming to market to raise dollar debt just days after a fresh wave of US sanctions on Russia.

-

Equity and debt markets were fretting on Thursday over the implications of new US sanctions against Russia. A prohibition of US investment in Russian sovereign bonds marked an escalation in tensions, threatening sovereign borrowing costs. It could also damage Russian companies’ chances of funding in the capital markets, write Mariam Meskin and Sam Kerr.

-

Ukraine is once more at the forefront of emerging market investors' worries as military tensions with Russia escalate. Amid the uncertainty, Ukraine is fighting another uphill battle to access IMF funding in order to recover its economy as soon as possible. The governor of the National Bank of Ukraine, Kyrylo Shevchenko, spoke to GlobalCapital about the challenges the country is facing and the importance of central bank independence.

-

Anna Vasilenko, a former managing director at the Moscow Exchange, has joined EM, the strategic advisory and communications firm for clients in Russia, China and other emerging markets, as its CEO.