Rabobank

-

Banker brings wealth of experience from capital market roles

-

◆ RBC leads European banks to funding in the US ◆ Once JP Morgan starts the third quarter bank earnings season local FIG bond wave could materialise ◆ This could keep market busy until US election

-

◆ Dutch bank pushes sterling funding through its euro secondary curve ◆ Max size achieved ◆ Investors remain glued to the deal as they foresee performance amid supply scarcity

-

◆ Another $500m no-grow launched ◆ Can’t stay away from the dollar market ◆ Fair value hard to pin down

-

◆ ’One of the best trades’ from the past two weeks ◆ Dutch agency chooses short maturity ◆ NIPs have ‘crept up’ but deal priced tight

-

-

◆ Ten year Länder paper widens against KfW ◆ Deal strikes balance between size and price ◆ Investors on board despite deeply negative OAT spread

-

German state launches oversubscribed €500m deal close to secondary curve

-

IADB taps sterling while two other issuers mandate for new issues

-

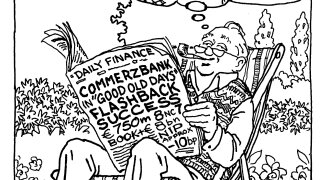

◆ Leads say deal landed well inside fair value ◆ Rivals say result points to ‘halcyon days’ of early 2024 ◆ Other issuers said to be eyeing Rabobank's callable FRN structure

-

Some bankers were surprised, others not, but all expect a reduced EU funding programme for 2024's second half

-

Dutch issuer has now funded two thirds of its annual programme