Pakistan

-

China and Pakistan like to describe their relationship as sweeter than honey and stronger than steel. As a huge China-backed project to overhaul Pakistan’s creaking infrastructure takes shape, Pakistani bankers are steeling themselves to discover just how sweet that Chinese investment might be

-

The Government of Pakistan’s Privatisation Commission is seeking lead managers and book runners for an IPO of state-owned Gujranwala Electric Power Company (Gepco), according to an announcement on the PC website.

-

Daewoo Pakistan Express Bus Service is planning an up to $48m IPO in the country amid expectations of a pick up in share sales this year.

-

Market participants in Pakistan are bullish about the prospects for the local bourse after a Chinese-led consortium won the bid to buy a 40% stake. Bankers and brokers expect the new owner to take the Pakistan Stock Exchange (PSX) to the next level and inject not only capital, but also credibility. John Loh reports.

-

Pakistan International Airlines (PIA) has tied up funds totalling $130m via a syndicated loan facility.

-

The Pakistan Stock Exchange will sell a 40% stake to Chinese buyers including the Shanghai Stock Exchange (SSE), ending a months-long search for strategic investors.

-

Standard & Poor's has boosted Pakistan’s credit rating to B from B- on the back of improvements in the economy and the outlook of its fiscal and external positions, as well as better governance.

-

IPOs are on the verge of getting easier in Pakistan. The country’s market regulator has approved a new framework with the primary objectives of making it easy to do business and streamlining the public offering process.

-

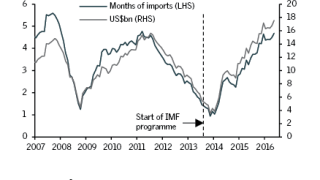

A frontier market that was flirting with insolvency just three years ago, is now in rude health. Investment is flooding into Pakistan from China, the West and the Gulf, attracted by high returns, rising stability and an economy underpinned by strong growth figures and a pro-business government.

-

Chinese investment has transformed Pakistan as an FDI destination. With the number of terror attacks falling and the northern borders about be opened up, Pakistan will become a major trading nation in the decades ahead, further boosting inflows of investment capital.

-

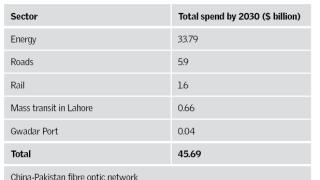

Pakistan is set to become one of the world’s great economies, benefiting the $46bn China-Pakistan Economic Corridor, which will link Beijing with the Indian Ocean overland for the first time. An influx of Chinese — and global — capital will boost growth and foreign direct investment, buoy the construction sector, and help transform Pakistan from a nation of separate and often fractured provinces, into a single, co-ordinated, consolidated country

-

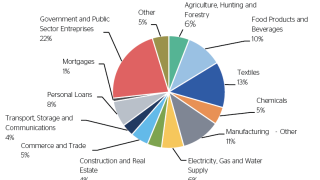

Pakistan’s banking sector is in its best shape for years, as bad loan ratios fall, capital adequacy and profits rise, and new legislation allows lenders to process a logjam of bad assets that has long bedevilled the system