North America

-

Market participants hope more jurisdictions will follow as Canadian duo attract record demand

-

Loan market tranquil but outlook is not pretty

-

Banks see opportunities in supporting direct lenders' ESG loan initiatives

-

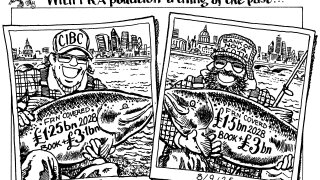

◆ Possible record demand for first non-UK benchmark since PRA debacle in April ◆ Deal lands flat to fair value and euros ◆ Market hopes more names will follow

-

◆ Engie electrifies orderbook ◆ Deal lands flat to or a touch wide of fair value ◆ Frontloaded issuance forecast for next week

-

Big deals offer a chunky margin to fee starved lenders

-

◆ TD prints largest euro deal for a year ◆ Strong demand for rare three year notes ◆ Minimal premia needed

-

Multi-year high August volumes raise questions for next month's issuance

-

Diverse deals hit US market as investors look for yield pick-up across issuer types and formats

-

◆ Five year 'would have been simple option' ◆ Building on success of World Bank ◆ Swap spreads steady despite heavy issuance

-

◆ Issuer's first euro 10 year for a while ◆ 'Exceptional investor base' built over the years ◆ Pricing tighter than OMERS and provinces in secondary

-

Insurance firms and less frequent borrowers dominate issuance