North America

-

As supply becomes scarcer, it will be easier for companies to sell dirty debt as green

-

◆ Foreign FIG issuance so far in 2024 outstrips last year’s volume by more than $20bn ◆ Multiple Canadian and Japanese lenders print ◆ US banks prepare capital plans after the Fed’s latest stress tests

-

Highly rated names land smooth trades after investor demand showed signs of weakness for corporates last week

-

Issuer cannot tighten from initial price thoughts as market remains hostile to lesser known names

-

Canadian issuer taps into three different currencies within one week

-

Canadian issuer takes bigger amount than originally targeted

-

Issuer refreshes euro presence after 2.5 years and wants to issue annually

-

The Japanese carmaker and the Canadian bank were among five issuers to tap the market on Monday

-

US medtech firm sourced more than half of $4.2bn debt needed in the €1.8bn trade

-

◆ Slim premium paid on chunky sale ◆ Investors welcome Canada pick-up to UK names ◆ Canadians missing from covered bonds

-

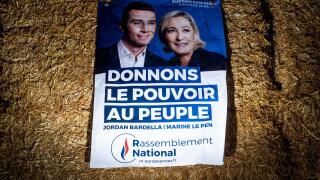

European markets need to prepare for six months of politically-driven market volatility

-

◆ Low beta issuers 'more challenging to sell' ◆ Investors turn cautious on FRNs ◆ New issue premiums 'will come back'