North America

-

Canadian borrower mandates for deal ahead of what is forecast to be a big week for issuance volumes

-

Federal Reserve kept rates steady but only one company emerged after FOMC meeting

-

◆ Handful of European banks go Stateside after quarterly earnings ◆ Some revisit dollar funding despite it not offering best relative cost ◆ HSBC goes for size as its triple trancher surpasses BofA's $5bn print

-

◆ Triple tranche trade finds mixed demand ◆ Shortest tranche lands inside fair value ◆ 'Significant' demand for high rated short end to park cash

-

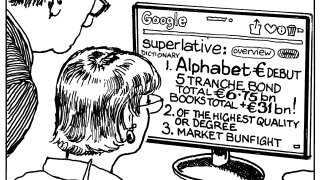

Google owner returns to dollar market for first time since 2020 for joint tightest 30 year spread ever

-

Fiserv and Visa print across the curve with more tipped to come

-

◆ Books bulge for three year deal ◆ Sizes and new issue concessions reflect demand differences ◆ Trade comes amid major data dumps

-

◆ BofA taps market with a perp in post-earnings appearance ◆ Varied issuance from US and Japanese insurers ◆ Citi the only large US bank not to have issued in dollars after quarterly results

-

Improving sentiment lures retail giant but issuer opts for short end

-

Donald Trump’s assault on the tenets of US financial exceptionalism is a boon to European capital markets

-

Supreme Court decision could put Federal Reserve's independence at risk

-

◆ US firm picks euros to refi dollars ◆ Investors see whipsawing arbitrage between currencies ◆ General Mills deploys bookbuilding tactics designed to sooth investors