Natixis

-

French bank is a force in covered and overseas unsecured issuance

-

◆ French bank raises €500m from a 12 year non-call seven tier two social bond ◆ Strong demand for FIG capital pushes final book to €5.6bn ◆ UBS returns to Singapore with fresh AT1

-

The duration issuer ‘does not gamble on rates’ but pledges regular issuance pattern

-

Banks push longer and tighter but investors keep coming back for more

-

Steep rise in hybrid yields makes companies look for ways out of replacement obligation

-

◆ French bank goes beyond recent 10 year senior, covered deals ◆ UniCredit pushes pricing in SNP with 5bp NIP ◆ Market open for all as infrequent borrowers also lure big orders

-

◆ Foreign quartet prices $9.25bn across the capital stack in three days ◆ SocGen joins the post-CPI flow on Thursday ◆ US money-center banks expected to unleash issuance after earnings

-

BPCE, Mediobanca and BayernLB all delivered on mandates revealed last week

-

A slowdown in supply is expected amid 'trickier' backdrop

-

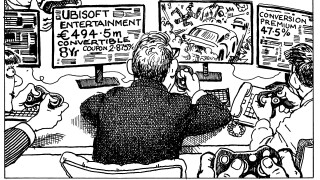

Shares in the French game publisher fell more than 8% after the convertible and delta placed

-

Banker to cover financials, public sector issuers and asset managers

-

Bankers say it is hard to say why demand for the deals was subdued