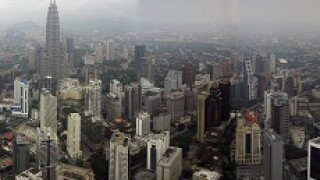

Malaysia

-

Four firms from Asia ex-Japan are taking bids for their dollar bonds, including Lionbridge Capital Co, Nan Hai Corp, Overseas Chinese Town Enterprises Company as well as Malaysia’s Yinson Holdings.

-

Bank of Tokyo-Mitsubishi UFJ cleaned up its position in CIMB Group this week, offloading more than 400m shares in an accelerated bookbuild to raise MR2.55bn ($607m).

-

Malaysian companies have finally started taking steps towards sustainability, about three years after the country put together its SRI sukuk framework. The potential for growth is huge, and with the right encouragement and a conscious partnership between Islamic financing and sustainable goals, Malaysia can make itself a leading green market.

-

Credit Suisse has hired a senior banker from Maybank to head up its Malaysian investment banking coverage, sources said.

-

Malaysia has seen the inaugural green sukuk under the Securities Commission's Sustainable & Responsible Investment (SRI) sukuk framework, highlighting the country’s efforts in meeting the growing needs of global infrastructure and green financing.

-

Malaysian lender Maybank priced its first onshore renminbi bond on July 21, with the Rmb1bn ($148m) three year deal closing books early in the afternoon.

-

Malaysia’s insurance sector looks poised for consolidation following a recent central bank directive that could kick off a flurry of IPOs.

-

Malaysian sovereign wealth fund Khazanah Nasional has pocketed MR571.2m ($133.3m) after selling a small piece of CIMB Group. A competitive bidding process for the mandate meant wall-crossing investors beforehand was impossible, leading to a slow but steady bookbuild.

-

Panda bonds are finally coming back to life after a dire first half. But although all the conditions are in place for an issuance boom, there is reason to doubt quite how high volumes will go.

-

The State Council grants PBoC greater powers with new commission, China reports 6.9% year-on-year GDP growth in the second quarter, and Spain plans its first Panda bond.

-

A recent directive from Malaysia’s central bank could spark off a round of consolidation or IPOs among the country’s insurers, according to ECM bankers.

-

One more bank has signed a facility agreement with the Employees Provident Fund of Malaysia for a £130m ($168m) financing. That takes the strength of the syndicate for the loan to three banks.