Loans and High Yield

-

JP Morgan is running the acquisition financing for Ion Investment Group’s purchase of Italian banking software group Cedacri, a major shift for the finance, technology and data group, which has relied on Credit Suisse and UBS to fund its spree of its debt-fuelled acquisitions. The group also turned to high yield bonds for the first time recently, a major departure for a company which once prized the privacy of the loan market.

-

Guandong Haid Group Co, a Chinese agricultural and animal husbandry company, is in the loan market with its debut offshore borrowing of up to $400m.

-

EQT achieved a strong response from investors on Friday when it launched the first sustainability-linked bond from a private equity firm, and only the second from a financial company. The €500m deal is tied to greenhouse gas emission cuts and gender diversity metrics.

-

French steel parts and distribution company Jacquet Metal Service has launched a further Schuldschein, according to sources. The market is gearing up for somewhat of a renaissance after a moribund 2020 and GlobalCapital understands that 10-15 more transactions are set to be launched in May.

-

Three regular dollar bond issuers from China were the first out of the gates to tap investors on Thursday following a long holiday in the Mainland.

-

Golden Energy and Resources drew in investors with an 8.875% yield on its bond on Thursday, allowing the mining company to raise $285m.

-

Golden Goose, the Italian shoemaker bought by Permira just before the coronavirus pandemic struck Europe, is looking for €470m of senior secured bonds in what may be the last repayment of a bridge facility signed before Covid. Hung bridges for leveraged buyouts were a serious concern for banks at the height of the pandemic but due to governments and central banks supporting the financial markets, lenders sold down the positions successfully — mostly much earlier than Golden Goose, writes Silas Brown.

-

Tullow Oil has tightened the already restrictive terms on a new $1.8bn senior secured bond, applying further limits to dividend capacity and restrictions on paying down its unsecured 2025 bonds early. But the company had few other options to stave off a restructuring, other than taking what the market will bear, and the bond looks set to price at the tight end of the 10.25%-10.5% guidance.

-

French optician Afflelou is looking to sell senior secured high yield notes, in order to pay back state loans and refinance outstanding debt.

-

Banks backing the successful Allied Universal bid for UK security company G4S are set to split around $100m in financing fees for backing the deal, with Credit Suisse and Morgan Stanley in line for the lion’s share of the profits, as the $6.3bn eight tranche syndication is priced and the firm is delisted.

-

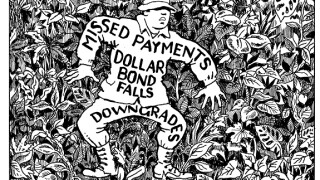

Indonesian textile company Sri Rejeki Isman (Sritex) saw its bonds plummet in the secondary market this week, as investors grappled with the company's missed debt payments and a series of ratings downgrades. Morgan Davis reports.

-

Philippine property developer SM Prime Holding has returned to the loan market after an absence of five years.