Loans and High Yield

-

Virgin Media Ireland’s debut standalone leveraged loan has seen some resistance from lenders, and the company has conceded changes to the documentation, limiting its flexible to layer in additional senior debt. With commitments due on Thursday, it looks set to land at the wide end of the 325bp-350bp talk.

-

Valeo Foods, the Irish ambient food business, is looking to raise nearly €1.2bn-equivalent of loans to finance its secondary buyout by Bain Capital from previous sponsor CapVest Partners.

-

Tyre manufacturer Gajah Tunggal had to battle weak sentiment around Indonesian credits to sell a $175m bond this week.

-

eHi Car Services tapped its 2024 notes for an additional $150m on Wednesday, bringing the total deal size to $450m.

-

NH Hotels has successfully refinanced its existing 3.75% 2023 bonds with a new €400m five year non-call two high yield bond, with the hotel chain supported ahead of the issue by a €100m cash injection from its shareholder, Thailand’s Minor Group. It will carry on shoring up its liquidity position in the months ahead, with a €200m sale-and-leaseback deal set to close shortly.

-

GlobalCapital reveals today the winners of its Bond Awards 2021, including celebration of the achievement of top corporate banks and issuers — and Lifetime Achievement Awards for two of Europe’s most prominent corporate funding officials.

-

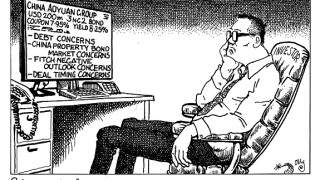

China Aoyuan Group’s attempt to woo investors to its $200m bond with a generous yield fell flat on Tuesday. Recent concerns about the property developer’s leverage, and the subsequent fall of its dollar bonds in the aftermarket, held investors back from the new deal — and caused a further spiral in secondary. Morgan Davis reports.

-

VPBank Finance, the consumer finance arm of Vietnam Prosperity Joint Stock Commercial Bank, has returned to the loan market just four months after its last deal. But this time around, it has brought together a diverse mix of lenders to run its fundraising — a rarity for transactions from the country. Pan Yue reports.

-

Frozen food supplier Nomad Foods has launched the bond leg of the financing for its acquisition of central and eastern European peer Fortenova, having priced the loan part earlier this month.

-

Vietnam’s SSI Securities Corp has returned to the loan market, just six months after its last deal.

-

Spanish car parts maker Antolin is looking to sell €390m of seven year notes, in a bid to refinance its bonds due 2024 early.

-

Nobian, the industrial chemicals unit of Nouryon, launched the debt package for its spinout on Friday, offering up a €1.19bn ESG-linked five year term loan 'B' through Credit Suisse, HSBC and JP Morgan. This will be followed by a bond deal, which is yet to be announced, to complete the €1.615bn senior secured financing.