Learning Curve

-

In the Lehman Brothers collapse numerous market participants trading derivatives lost substantial amounts of initial margin they had posted to Lehman as a counterparty to secure their swaps.

-

The full facts remain elusive but, according to the MF Global bankruptcy trustee, some USD1.2 billion may be missing from MF Global’s segregated customer account.

-

The enactment of the Dodd-Frank Wall Street Reform and Consumer Protection Act in the summer of 2010 made an impact both in the U.S. and internationally. Dodd-Frank altered the landscape of the capital markets through an imposition of vast federal regulation.

-

The European Parliament threatened a blanket ban on credit default swaps in E.U. member states, identifying them as a major contributor to current eurozone instability. The compromise text which has now been adopted is considerably less alarming than that. Most hedging purposes for which sovereign CDS are currently used are protected; it is only the truly speculative activities which will be prohibited.

-

Credit value adjustment is the amount subtracted from the mark-to-market (MTM) value of derivative positions to account for the expected loss due to counterparty defaults.

-

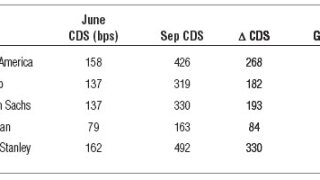

The growing prevalence of CDS spreads as default risk indicators raises a fundamental question: how well have spreads performed in predicting defaults?

-

On July 21, 2010, President Barack Obama signed the Dodd-Frank Wall Street Reform and Consumer Protection Act into law.

-

The use of derivatives by mutual funds and exchange-traded funds has surged over the past several years. With funds providing exposure to alternative asset classes and developing more complex trading strategies, derivatives transactions now occupy a prominent position in mutual funds’ and ETFs’ investment portfolios. In response to what the Securities and Exchange Commission refers to as the “dramatic growth” of derivatives in the regulated fund space, it recently issued a concept release to evaluate whether the existing regulatory framework applicable to mutual funds and ETFs remains sufficient to protect investors from the risks and challenges of using derivatives.

-

One of the key shortcomings of the first two Basel Accords is that they approached the solvency of each institution independently.

-

The 2011 ISDA Equity Derivatives Definitions were published July 8, 2011 after a process lasting more than 17 months and involving more than 60 market participants on both the buy- and sell-side.

-

English derivatives lawyers have become accustomed to waiting years for judicial guidance on the interpretation of market documentation.

-

Credit index options--or credit swaptions as they are often referred to--came of age during the credit crisis, with liquidity picking up significantly since. Net notional outstanding currently stands at USD80 billion with trading volumes reaching up to 500 trades a week.