LatAm Bonds

-

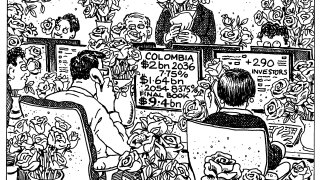

Excitement is brewing among Latin America debt capital markets bankers over the prospects for the region’s three largest bond markets. But there is also trepidation that any deviation in the path of US interest rates could derail their impressive recovery, writes Oliver West

-

The awards recognise the leading deals, individuals and institutions in Latin America's cross-border debt capital markets

-

Pampa Energía latest to join bond pipeline after Argentina's first true debut issue for six years

-

International angle enables both Mexican issuers to draw interest beyond traditional EM buyers

-

The terms of the tender offer are 'generous', said Tellimer

-

Sovereign authorised to issue up to $1bn but some investors still have doubts on IMF programme

-

'Stressful' Trump victory could make EM a tricky sell for fund managers, but Banorte, MSU test appetite

-

Execution impresses as sovereign found itself in sub-par market conditions

-

Spanish bank sees ‘strategic rationale’ in being in Brazil as it looks to up wholesale banking revenues

-

Colombian quasi-sovereign pays 15bp more than last week's cancelled deal, but mostly thanks to wider market

-

Latin America's largest carrier says that new senior secured bond will save it $83m in interest expense

-

Latin American supranational extends its curve with second Swiss visit of the year