LatAm Bonds

-

Hefty tightening fails to dampen demand as dual-tranche green deal trades up in grey

-

Sovereign's largest ever new issue received positively, despite issuer's many credit challenges

-

Winners will be announced on April 16 at a live event in New York

-

Petrobras-style solution may be needed to fix Pemex for good, said one fund manager

-

The first ever female head of a Latin American development bank wants to focus on transparency, efficiency and impact

-

Bank treasuries drawn to more liquid deals as LatAm supra plans to stay active with sterling trade

-

Investors saw plenty of juice in first public AT1 from Chile as regulatory framework draws praise

-

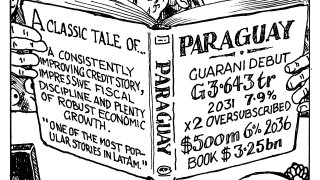

Years of credit improvements have given landlocked country a loyal following among EM investors

-

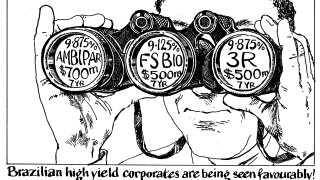

Make way for the Latin American high yield companies that put the 'emerging' into EM bonds

-

Latin American corporate issuance comeback has beaten the expectations of some investors

-

Oil and gas junior becomes LatAm's first debut issuer of the year with Ambipar to come

-

Appetite for 30-year strong as LatAm’s largest sovereign notches its biggest new money trade