L-Bank

-

L-Bank, the state development bank of Baden-Württemberg, took to the long end in Australian dollars on Tuesday. The agency was able to benefit from pent-up demand for long dated Kangaroo paper to sell its second trade in the format this year.

-

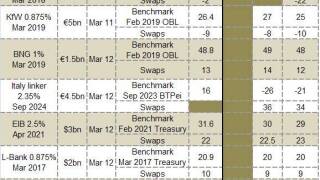

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Investors flocked to buy short dated sterling paper from L-Bank on Wednesday, allowing the issuer to almost double its minimum size ambitions. The agency offers a pickup over other triple-A rated German agencies, buoying investor demand for the print.

-

L-Bank became the second German agency to find strong demand in the two year part of the dollar curve this week, pricing a $2bn June 2016 at the tight end of guidance on Thursday.

-

This week's scorecard focuses on the funding programmes of selected German states and agencies. Most of this week's issuers are already more than halfway through their 2014 funding requirement.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Cades and KfW were the latest issuers to add to a flood of dollar issuance on Wednesday afternoon, hiring banks for a 10 year and four year deal respectively. The European Investment Bank and L-Bank both enjoyed solid demand for benchmarks of their own on Wednesday.

-

The European Investment Bank and L-Bank will add to a deluge of dollar issuance on Wednesday. The issuers mandated on Tuesday for benchmark deals on Tuesday, following deals by Denmark, Agence Française de Développement and the Bank of England.

-

This week's scorecard focuses on the funding programmes of selected German states and agencies. Next week's scorecard will feature French agencies.

-

Kangaroo issuance is expected to remain healthy through to the end of the week as investor demand for Australian dollar paper remains strong. L-Bank has mandated for its first Kangaroo in nearly four years, while Kommunalbanken has also hired banks for a deal and a third issuer is expected to announce a trade on Thursday.