Kyrgyzstan

-

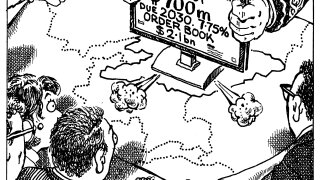

Pricing was tight after sovereign found healthy demand

-

The country is set to offer less than 100bp of spread over Uzbekistan

-

Transparency is an issue for the central Asian state, said one sovereign investor

-

Economic growth in Central Asia is picking up but experts at the IMF are concerned that leaders are not doing enough to address fiscal deficits

-

The European Bank for Reconstruction and Development has printed a medium term note linked to Kyrgyz government debt.

-

In this round-up, Hong Kong and Taiwan RMB deposits shrink slightly while RMB cross-border trade settlement surges to new records in both Hong Kong and China, the RQFII programme reaches Rmb410bn ($80bn), Georgia and Kyrgyzstan work on establishing RMB swap lines with China, and Nanning authorities plan a new China-ASEAN currency index.

-

Russia’s DeltaCredit Bank has opened books on a Rb5bn ($151m) five year covered bond and is aiming to close the deal by Friday, said bankers on the deal.

-

Société Générale’s Russian subsidiary, DeltaCredit Bank, is expected to place notes of its recently priced covered bond on Tuesday, its treasury told The Cover. It is expected to return with further deals next year as the Russian fledgling covered bond framework continues to restrict local issuers to their domestic market.

-

The Russian mortgage market has grown quickly, lifting prospects for fledgling covered bond issuance. However, despite being Ucits eligible and in line with the European Covered Bond Council’s Label definition, the country’s legal framework is not yet aligned with western Europe’s.

-

In the midst of the global financial crisis, officials at the National Bank of Azerbaijan are making time to review a draft covered bond law for the South Caucasian country, in a sign of their commitment to a project that is aimed at stimulating its mortgage market.

-

Reduced bank funding options, a growing reliance on retail deposits, and a frozen secondary real estate market. Sound familiar? No, it’s not the US, but Kazakhstan. But while covered bonds are coming to the fore in the States and being taken up in CIS countries such as the Ukraine, the market’s direction in Kazakhstan is less clear.

-

When the Federal Deposit Insurance Corporation’s and US Treasury’s covered bond announcements came out, David Lucterhand, chief of party at Access to Credit Initiative (ATCI) in Kiev, reacted by writing to colleagues: “Finally, somebody understands what we’ve been talking about for years!”