Korea Investment and Securities

-

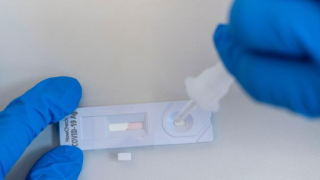

Timing changes but the Koran diagnostics firm's deal size to remain the same

-

-

Top 10 investors took over 80% of the shares sold by conglomerate Doosan Corp

-

The Korean policy bank dropped a longer fixed rate tranche in favour of a green floating portion

-

The GlobalCapital Asia Best IPO for 2021 is South Korean firm KakaoBank Corp's W2.55tr ($2.1bn) IPO.

-

The fifth largest South Korean securities house got away with zero new issue premium, and could be the last issuer from the country this year

-

South Korean shipbuilding company eyes September listing

-

Hyundai Heavy Industries Co, the world’s largest shipbuilder, is aiming to raise up to W1.18tr ($1.03bn) from its IPO, bringing yet another chunky listing to the South Korean market.

-

South Korea’s stock exchange has approved Hyundai Heavy Industries Co's IPO of around W1tr ($875.4m).

-

HK Inno.N Corp, a South Korean pharmaceuticals company known for its popular hangover tonics, has priced its IPO at the top of the marketed range, netting W596.9bn ($520.9m).

-

South Korean car rental company Lotte Rental has launched the roadshow for its IPO, looking for up to W850.9bn ($739.2m) in proceeds.

-

Kakao Bank has defended its valuation following a W2.55tr ($2.2bn) IPO after being questioned by South Korea’s regulators about its high pricing. The internet-only bank is only the latest in the country to be targeted by authorities cracking down on lofty valuations of new listings. Jonathan Breen reports.