Kommuninvest

-

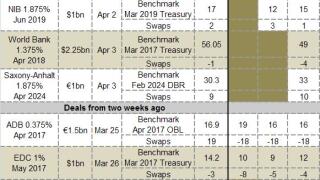

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

The dollar market went from strength to strength this week, with a trio of issuers gliding seemingly effortlessly through tightly priced deals. While this may signal to other SSAs that it’s time for some aggressive pricing of their own, things might not be that simple.

-

Swedish municipality finance agency Kommuninvest sailed through its first dollar benchmark of 2014 on Tuesday, selling three year debt inside of its secondary levels. The issuer’s rarity and a positive spread over swaps allowed it to achieve an oversubscription, in spite of the aggressive level.

-

Kommuninvest mandated for its first dollar benchmark since October 2013 on Monday, a three year deal. Several other Scandinavian issuers are looking at dollar deals according to syndicate bankers, including the Nordic Investment Bank and Swedish Export Credit Corporation (SEK).

-

This week's scorecard features Scandinavian agencies, with Kommunalbanken and Municipality Finance getting their funding programmes off to a strong start over January. Next week's scorecard will provide updates on CEE sovereigns' funding.

-

Swedish local government financing agency Kommuninvest plans to raise 45% of its funding requirement in its domestic currency in 2014.

-

Issuers would be wise not to dither come January, according to syndicate bankers, with several borrowers that are usually only seen in the dollar market plotting euro deals for 2014. Coupled with what is expected to be a busier than normal start to the year, the calendar — especially in euros — looks to be packed.

-

A shift by agencies towards symmetrical, two-way credit support annexes (CSAs) could well be the best present SSA bankers receive this Christmas. Even supranationals are starting to move towards equal swap agreements.

-

Top rated issuers with two-way credit support annexes could find a competitive advantage in the growing Uridashi market in the new year, with the agreements useful for printing highly structured notes that can entice yield hunting investors up the credit curve.

-

Kommuninvest hopes to pioneer a number of new structures on the Uridashi market in 2014, looking to introduce variety to its issuance in order to respond to changing investor interest in light of a rejuvenated Nikkei stock index.

-

This week's scorecard features Scandinavian agencies. Most of the issuers have completed their funding targets for the year, though Kommunalbanken, Municipality Finance and Swedish Export Credit Corporation have all expressed interest in prefunding for 2014.

-

This week's scorecard features Scandinavian agencies. Several issuers have completed or are near completing their funding targets for the year, and some are contemplating prefunding their 2014 needs before the end of the year.