KommuneKredit

-

Municipality Finance on Thursday became the second European SSA to enter the Swiss franc market this week, after Nederlandse Waterschapsbank became the first European SSA to place Swiss bonds since 2015.

-

A pair of three year prints in dollars provoked very different reactions from GC BondMarker voters in the second quarter. Read on to find out more in this week’s BondMarker round-up, which looks at the most notable dollar deals of the last quarter.

-

This week's funding scorecard looks at the progress Nordic agencies have made in their funding through the first half of 2017.

-

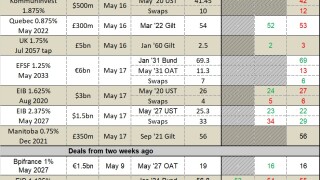

The scores have been counted and the results for the benchmarks sold in the week commencing May 29 are in. The week produced only a smattering of public sector trades trades, and not all were warmly received.

-

There was just a smattering of public sector dollar deals this week — but a wide difference in how they fared.

-

KommuneKredit fell short of full subscription with a three year dollar benchmark on Thursday, with few updates provided through the book building process.

-

Public sector borrowers are aiming for the short end of the dollar curve, as swap spreads in the area hover around the spot in which they started 2017, having dropped sharply from the year’s highs hit in March.

-

Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Guarantor: All Danish municipalities and regions

-

With borrowers universally ahead of schedule in their funding programmes but investors hungry for more supply, attention is turning to the market for socially responsible investments. Three agencies hit screens to sell SRI bonds this week, while a fourth is on the road marketing another.

-

A pair of agencies launched socially responsible investment deals in euros on Tuesday, while a third picked banks for a dollar trade.

-

The SRI bond pipeline for public sector borrowers looks fit to burst, with a string of issuers planning deals and KfW setting a marker with a thumping trade this week.