Jefferies LLC

-

Genscript Biotech Corp is planning to spin-off and list subsidiary Legend Biotech Corp in a potential $100m Nasdaq IPO. The firm submitted listing documents to the US regulator on Wednesday.

-

Dada Nexus, an operator of Chinese on-demand retail and delivery platforms, has set the ball rolling for a Nasdaq IPO.

-

Analysts have praised UniCredit for taking a conservative approach to dealing with the coronavirus pandemic, after the Italian bank said on Wednesday that it would be making higher loan losses provisions in the first quarter than had been expected by the market.

-

Jefferies said on Sunday that its chief financial officer, Peregrine ‘Peg’ Broadbent, had died of coronavirus complications. Broadbent had been CFO of the group since 2007, and helped it more than double in size.

-

Premier Oil’s stock surged by more than 65% on Friday after the company gave an update on its cash position following this week’s equity market slump, a positive for the banks working on its rights issue. However, the deal also hinges on a court case in Scotland.

-

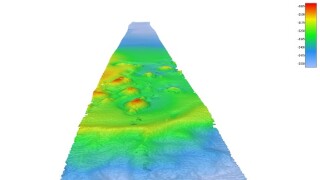

The only high yield bond deal being actively marketed in euros this week has been postponed. The deal was for Fugro, the Dutch company that provides geographical data and asset integrity services to onshore and offshore industries. It was a debut issue for a listed company with no sponsor involved, so there had been good interest, but market conditions just proved too difficult.

-

DRI Healthcare, the Canadian investment fund focused on pharmaceutical royalties, has postponed its $350m IPO on the London Stock Exchange, blaming the global equity market selloff caused by the spread of the Covid-19 virus.

-

Conditions are changing so fast with the coronavirus epidemic that each day could bring a change in sentiment, but for the time being leveraged finance is staying calm and continuing to function. There is more activity in this high risk corner of Europe’s capital markets than in any other, apart from sovereign, supranational and agency bonds.

-

The European Stability Mechanism has requested its primary dealers or ‘market group banks’ to set up entities within the 27 member states of the European Union in order for them to participate in bond auctions by the supranational and its sister issuer, the European Financial Stability Facility.

-

Barbeque-Nation Hospitality is planning an IPO of up to Rp12bn ($167.8m). It has revived its listing plans two years after first announcing the transaction.

-

Canada’s DRI Capital is preparing to list a new fund on the London Stock Exchange focused on investing in pharmaceuticals royalties.

-

A major shareholder in SLM Solutions Group, the German maker of 3D printers, sold a chunk of his stake in the company, via an accelerated bookbuild on Thursday.