Japan

-

◆ French bank offers six tranches between three to ten years ◆ Investor preference for short dated tranches prevails ◆ Rate rises expected in Japan

-

London's airport is the third foreign corporate to tap the Swiss market this week

-

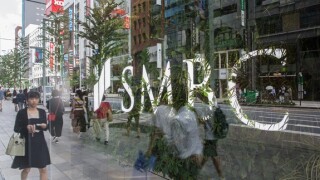

Japanese bank goes ahead of peers by merging bank and securities firm in EMEA

-

Domestic investors dominate shorter tranches, foreigners support longer bonds as Mexico hits size target

-

Car company lands inside euro curve with single digit premium

-

Region’s investors are keen to buy global bonds, while non-Asian issuers are looking to leverage Asia’s liquidity

-

Flight-to-quality fully on show in European government bond yields and spreads

-

Corporate/FIG crossover borrower cruises through near-empty market

-

Issuers both land big books as market quickly shrugs off French election volatility

-

Current funding head Ito remains at the Japanese agency as adviser

-

The Japanese carmaker and the Canadian bank were among five issuers to tap the market on Monday

-

Tokyo also made an appearance in dollar market with fixed rate deal