Japan

-

The executive chairman of Nomura’s Middle East and North Africa business is among those set to leave the firm as part of a big restructuring. Senior bankers in EMEA capital solutions and convertibles are at risk of redundancy

-

During an investor day on Thursday, Nomura said it will scale back some secondary trading operations in Europe, the Middle East and Africa (EMEA), as it seeks to adapt to global challenges in the wholesale sector and the region’s slower growth.

-

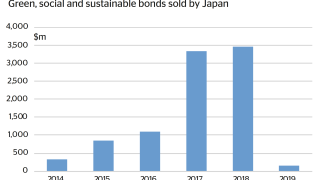

Outsiders often see Japan’s debt market as a staid place, where the maturity of investors and issuers leaves little room for innovation. The development of the green bond market puts the lie to that idea.

-

Japanese issuers’ supply of green bonds has rocketed in recent years. The country boasts a more diverse set of borrowers and a broader distribution of proceeds than many of its peers but further market development will present unique challenges, writes Morgan Davis

-

Japan’s top issuers occupy a unique part of Asia’s bond market landscape. They are well-regarded enough — and rated highly enough — that moments of fear in the credit markets can lead to more demand for their deals, rather than less. They face a domestic bond market defined by negative interest rates, an investor base that is ultra-sensitive to movements in the swap rate and an expectation from the government that their funding costs will remain tight.

-

The yen bond market, for all its vibrancy, cannot contain Japan’s ambitious issuers. Banks and corporates are building on efforts to woo dollar and euro investors as they thirst for new sources of funding, writes Morgan Davis

-

SNK Corp is set to launch an IPO using depository receipts (DRs) on the Korea Exchange next month. It is eyeing up to W169.7bn ($149.7m) in proceeds, according to a term sheet seen by GlobalCapital Asia.

-

The Japanese Financial Services Agency (JFSA) published risk retention rules on Friday that allow Japanese investors to avoid capital charges even if they buy debt from non-risk retention compliant deals.

-

Barclays has prepared new issuance in Japan while it waits out this week’s Brexit drama. The yen market is proving popular among European banks, which are taking advantage of favourable conditions to make total loss-absorbing capacity (TLAC) issuance.

-

Several CLO issuers in the US and Europe have come to depend on Japanese investors to anchor triple-A tranches, but observers say Japan’s banks may no longer be able to soak up foreign paper if a bubbling banking crisis forces banks to clean up their act at home.

-

Malaysia has closed the biggest sovereign Samurai bond in 18 years, raising ¥200bn ($1.79bn) from what could be just the first of many such deals to come.

-