Italy

-

The Hong Kong-listed Italian luxury yacht maker is seeking to list on its home exchange

-

◆ Secondary rally shows appetite for risk ◆ Issuers target quick intra-day execution before CPI ◆ HSBC starts by luring Asian demand

-

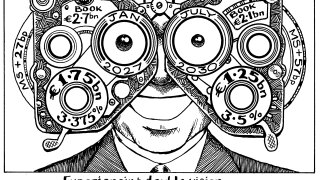

UniCredit Italy sets a strong precedent many of its national peers plan to follow

-

◆ Two issuers and two strategies ◆ Spread to differentiate as 'incremental fatigue' sets in ◆ Mixed expectations for June

-

German, Norwegian and Italian deals were successfully priced on Wednesday but lacked sparkle

-

Crédit Agricole Italia and other Italian issuers to follow

-

◆ UniCredit to end seven year absence from OBG mart ◆ More Italian deals set to follow ◆ Deal to offer RV compared to paper from more liquid jurisdictions

-

Longer funding offers issuers efficient use of collateral that's worth paying for

-

The Italian bank is basing the next phase of its development on international expansion and close collaboration with its private banking clients

-

Yachtmaker’s Chinese shareholder floated Ferretti in Hong Kong to get a better valuation

-

As the going got tough, the tough got their deals done leading to hopes of AT1s and Italian covered bonds

-

Sovereigns should take advantage of positive spreads and rating moves to get funding