Italian Sovereign

-

Italy issued its longest deal in nearly three years on Tuesday, raising €500m shortly before the European Commission decided to let the sovereign exit a budget restriction programme imposed in 2009.

-

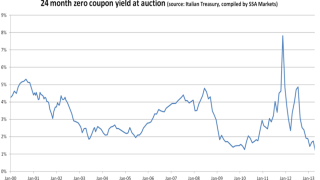

Italy set a euro-era record at auction for the fourth time in just over a month on Tuesday when it sold zero coupon bonds, as investors reacted warmly to political and macroeconomic news from the country. The strong sentiment may support further auctions later this week, according to analysts.

-

The EFSF has mandated three banks for a 10 year benchmark deal, which, should it go well, will wrap up a stellar week for borrowers associated with Europe’s sovereign funding crisis. The bail-out vehicle will follow a thumping €7bn sale in 10 years from Spain on Tuesday and what looks to be a successful €6bn 30 year sale from Italy on Wednesday.

-

Italy was set to price large 30 year syndication on Wednesday afternoon, in yet another stellar result for a peripheral European name this month. The sovereign wasted no time in announcing the trade after Spain received more than €21bn of orders for a 10 year deal, resulting in a €7bn print on Tuesday.

-

Italy has mandated five banks for the 30 year syndication it has planned to bring since the beginning of the year. Initially delayed by the inconclusive Italian election result at the end of February, the sovereign will have seen the conclusion of that saga at the end of April as well as syndication successes by Spain on Tuesday and Portugal last week as reasons to believe the trade may now work.

-

Italy auctioned 12 month bills on Friday at the lowest yields since the adoption of the euro. Despite the historical lows, the eurozone periphery rally over the last year may have further to go, said analysts.

-

The great eurozone periphery yield plummet showed no signs of flagging on Thursday, as Spain auctioned medium to long term debt at levels not seen since 2009. Italy is next up on Friday with a bill auction that analysts expect to be a similar success.

-

Portugal was set to pick up 10 year paper on Tuesday in its first new syndication since it received a bail-out in 2011. Heavy demand enabled the sovereign to set the size at its maximum target.

-

Italy scored its lowest cost of medium to long term funding since October 2010 at an auction on Monday, as the country’s political deadlock finally looked set to break following new prime minister Enrico Letta’s appointment of a cabinet over the weekend.

-

Italy broke records for the second time this week as it printed six month bills at the lowest yield since the introduction of the euro, with investor fears over the country’s political direction assuaged by the nomination of a new prime minister.

-

Italy rode on much-needed momentum in its political scene and expectations of an official interest rate cut to auction two year zero coupon debt at an all time low on Wednesday. The sovereign can look forward to a sale of longer dated debt early next week with even greater optimism, after the nomination of a new prime minister shortly after the auction.

-

A raft of positive news for the eurozone periphery helped Spain auction short term debt at record low yields on Tuesday and set Italy up nicely for debt sales later in the week.