Italian Sovereign

-

Bankers played down fears on Friday that a widening in Greece’s new five year bond could indicate poor sentiment for the country or the eurozone periphery as a whole, pointing to the limited scale of the sell-off. Elsewhere, Portugal received a ratings boost and Italy pushed down funding costs at an auction.

-

A busy week of auctions in the eurozone periphery received the best possible start as yields fell on expectations that the European Central Bank will introduce quantitative easing to the currency bloc — sending five year Spanish yields below those of US Treasuries. But despite that sentiment also extending to Greece’s secondaries, bankers warned that the country would be foolhardy to come with a much expected deal this month.

-

Ireland's return to bond auctions last month helped the sovereign reach nearly 60% of its funding target for the year. Across the Irish sea, the UK started its financial year with a £2.577bn auction - and a reduced funding target of £128.4bn.

-

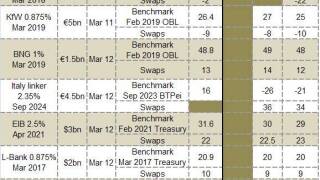

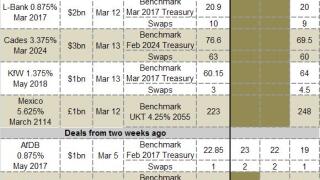

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

A shot of adrenaline to peripheral eurozone sovereign bonds this week helped set two milestones in the countries’ market recovery on Friday, as Italy auctioned 10 year debt at the lowest level in nearly a decade and five year paper at a record low, while Portugal’s 10 year yields broke through the 4% barrier.

-

Italy looks set to auction 10 year debt at the lowest level since 2005 on Friday after the sovereign’s yields dropped after the Bundesbank’s president hinted that the German central bank would not block quantitative easing or other extraordinary measures in the eurozone.

-

Italy gears up for an auction of 10 year debt this week amid signs that a rally in its debt since the start of the year has found a plateau.

-

The gargantuan Italian retail investor base is set for a shakeup after the sovereign brought long awaited changes to its BTP Italia product and the government proposed tax changes that could make government bonds more enticing for individual buyers.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Italy’s next syndication could be a 15 year nominal bond after it auctioned the tenor at a euro era low on Thursday, SSA Markets can reveal. The sovereign’s funding target for the year could also shift after the country’s prime minister revealed a raft of tax cuts and labour reforms this week. Meanwhile, Ireland made a comfortable return to bond auctions on Thursday.

-

Italy flew into a buoyant euro market with its first syndication of the year on Wednesday, raising €4.5bn with a doubly oversubscribed September 2024 inflation linked bond. But the sovereign has not finished business for the week — it auctions €6bn-€7.75bn of fixed rate bonds on Thursday.