Italian Sovereign

-

-

Range of trades on offer including rare floater and much delayed green euro debut

-

Dovish bias expected in first meeting since Russia invaded Ukraine

-

Italian 10 year bonds at widest spread to Germany equivalent since summer 2020

-

Sovereign follows France into inflation-linked market days after presidential election

-

Sovereign to join France as ECB faces growing pressure to raise rates

-

Issuers head to farthest reaches of the curve despite record inflation and looming rate rises before opportunity closes

-

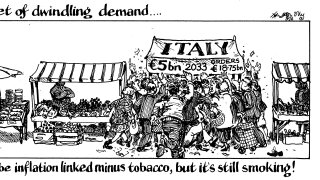

Sovereign drums up €55bn of orders for new benchmark despite macro and political worries

-

End of Pepp and potential for a President Draghi sends BTP-Bund spread to year wides

-

European syndicates confident yen will return as ECB eases off buying

-

Sovereign’s reduced funding needs means it is unlikely to print more debt than this year

-

Lack of upcoming syndications and arrival of EU to green bond market affect result of Bund auction