Italian Sovereign

-

In an age where the triumph of populism has shown that communication trumps all else in politics, it’s strange that the Italian iteration of this trend is struggling with something that couldn’t be clearer — its sovereign debt auction schedule.

-

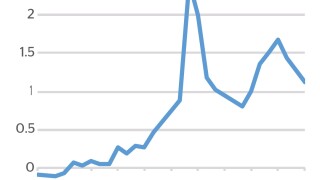

Italy’s bonds suffered another day of rising yields on Thursday after the country’s government appointed Eurosceptics to head financial committees.

-

Sovereign debt officials praised the role primary dealers played during the volatility that hit eurozone government debt markets in the second quarter, though some still feel the system is “not ideal”.

-

The recent swings in the sovereign, supranational and agency bond market due to political turmoil in Italy suggest issuers will have to change the way they execute deals in the coming months. Elsewhere, eyes are still trained on the European Central Bank’s tapering plans, while rising dollar yields are failing to attract SSA investors. Jasper Cox reports.

-

Quantitative easing, perhaps the single most important factor affecting bond prices over the past three years, could be coming to a long awaited end this year. Members of the European Central Bank governing council seemed to hint as much this week, causing govvie spreads to gap wider, writes Lewis McLellan.

-

The Basque Government this week gave one of the best signs that investor worries about Italy’s political situation are unlikely to spill over to other countries as it printed a three times subscribed debut sustainability bond.

-

European government bond yields have climbed in the wake of an unusually hawkish turn in the tone of comments from members of the European Central Bank's governing council.

-

The political upheaval in Italy is already making US investors go cold on European risk, which could magnify the market disruption Europe is likely to face in the coming months. The effects are even changing expectations on US monetary policy.

-

Government bond yields and swap spreads suffering a state of vibrato from the political fugue in Italy this week led to near silence across the primary public sector bond market. But issuers are hopeful a period of relative calm late in the week will last — although they admit investors are holding the baton.

-

Investors and analysts are assessing Italian banks in light of the fall in their capital ratios resulting from their exposure to sovereign debt.

-

Jitters over Italy’s political turmoil receded slightly on Thursday, giving Asia’s stock and bond markets a bit of respite, even as talk of a trade war between China and the US reappeared.

-

Italy passed its first debt raising test since its yields blew out earlier in the week amid fears of another round of elections, as it auctioned bonds near the top end of its target volume range on Wednesday. But the sale did show the elevated borrowing costs the country faces.