Issue 1870

Top Stories

-

Compelling relative value, larger sizes and greater outcome diversification hold key to developing market

-

'At least six' deals expected next week as SSAs prepare for the year's last big funding push

-

Bank starts small with its first traditional SRT but it could be a sign of things to come as investors get comfortable

-

Homogeneous CEEMEA issuance 'horrible' for some while others are hopeful

-

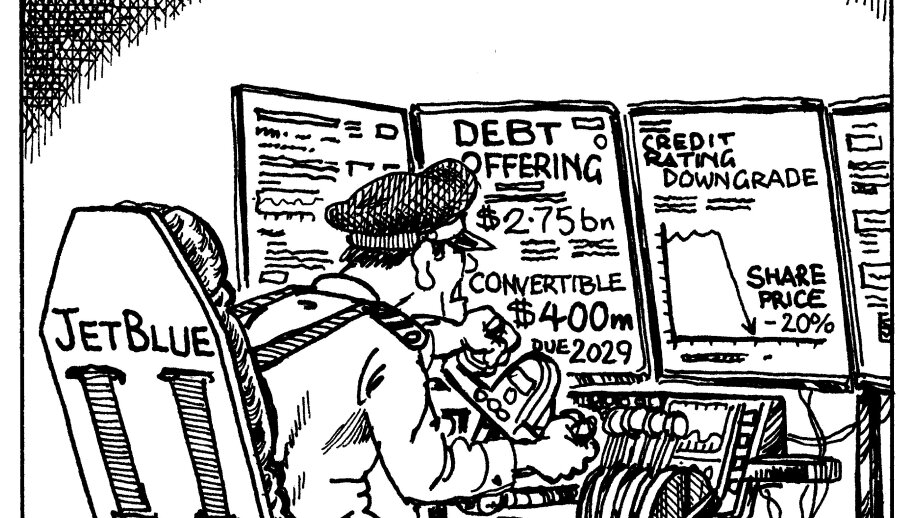

Missing US issuance could return to feed European investors ‘crying out’ for supply

Leader

-

It may look opaque from the outside, but US securitization is mostly a straightforward production line providing crucial financing

-

Volumes may be back to normal, but they're the only bit of the asset class that is

Public Sector

Financial Institutions & Covered Bonds

Securitization

Corporate Bonds

Syndicated Loans and Leveraged Finance

-

Company opts to raise green loan as lenders say pricing can be more competitive in the right circumstance

-

Borrower signs €249m deal to build Turkey’s second biggest solar project

Emerging Markets

Equity

People and Markets

Southpaw

Barclays and Citi are following rivals in scrapping the bonus cap for material risk takers in London. But after a decade of salary increases, the outcome could prove better for banks than for bankers