Issue 1831

Top Stories

-

Issuers take every opportunity to print as market turns tougher

-

Investors want to lock in high coupons while they can and issuers hope for lower costs

-

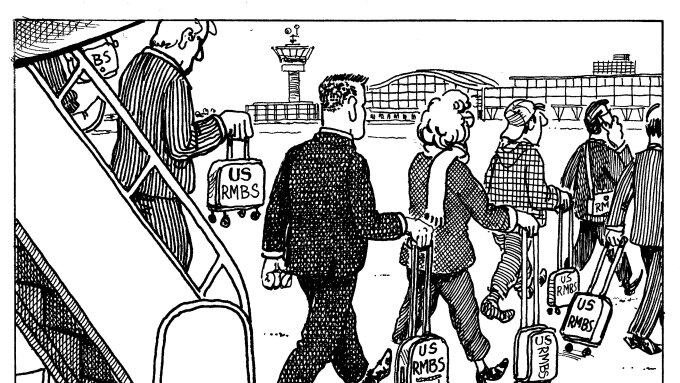

Regulatory clarity has opened the door for US RMBS issuers to tap European buyers, and transatlantic distribution is accelerating

-

Balance tilts further towards big shops as managers may have to invest in their own risk retention funds

Leader

-

Once the US market improves, it would make no economic sense for issuers to spend extra money on bringing deals to Europe

-

It will be success enough for covered bond issuers to get their deals away. They don't need to shoot the lights out

Public Sector

Financial Institutions

Covered Bonds

Covered Bonds

Securitization

Corporate Bonds

Syndicated Loans and Leveraged Finance

Emerging Markets

Equity

People and Markets