Issue 1810

Top Stories

-

The soda ash company failed to convince risk-averse investors to accept its valuation demands

-

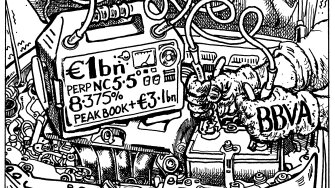

Demand for high yielding paper drives comeback for most subordinated bank capital

-

Tighter credit, declining property values and elevated interest rates will continue to squeeze issuers this year

-

Fall in SLL issuance could indicate ESG standards are tightening

Leader

-

Illiquid secondary markets are a flimsy indicator of risk appetite. EM needs primary action for investors to gain conviction

-

Public Sector

Financial Institutions

Covered Bonds

Covered Bonds

Securitization

Corporate Bonds

Syndicated Loans and Leveraged Finance

Emerging Markets

Equity

People and Markets