Indonesia

-

Indofood CBP Sukses Makmur made its dollar debut this week with a dual tranche $1.75bn bond. The Indonesian noodle maker overcame investor scepticism about its fundraising strategy by selling long-dated notes that saw a strong reception from the market. Morgan Davis reports.

-

Indonesia's dollar bonds were among the top performing investment grade notes in Asia last week, buoyed by signs of the country’s recovery from the pandemic.

-

Indonesian multi-finance companies are continuing to favour club loans over syndicated deals, with Federal International Finance becoming the latest firm to use this route for its fundraising. Pan Yue reports.

-

Freeport Indonesia is inviting banks to join the senior syndication stage of its $750m borrowing.

-

Indonesian multi-finance company Federal International Finance is making a quick return to the market for a $250m new money loan, having closed two deals in the past year.

-

Golden Energy and Resources drew in investors with an 8.875% yield on its bond on Thursday, allowing the mining company to raise $285m.

-

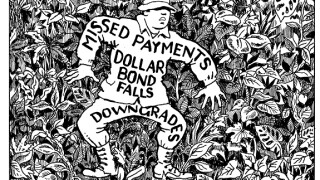

Indonesian textile company Sri Rejeki Isman (Sritex) saw its bonds plummet in the secondary market this week, as investors grappled with the company's missed debt payments and a series of ratings downgrades. Morgan Davis reports.

-

Indonesia's Sarana Multi Infrastruktur (SMI) has returned to the dollar bond market after a five-year absence, raising $300m.

-

Indonesian textile manufacturer Sri Rejeki Isman (Sritex) has seen its dollar bonds fall to new lows in the secondary market, as investors grapple with the company's missed debt payment.

-

AAA Oils and Fats, the trading subsidiary of palm oil company Apical, has returned to the loan market with a $750m facility.

-

Hyundai Motor Manufacturing Indonesia nabbed $300m from a five year bond on Tuesday.

-

Indonesian property developer Pakuwon Jati returned to the offshore debt market this week after a four year hiatus, selling investors a $300m seven year bond.