Indonesia

-

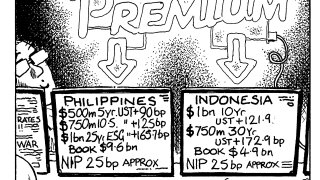

The Philippines and Indonesia break lull, potentially paving the way for IG issuers to sell bonds

-

Sovereign had to navigate widening spreads in the secondary market

-

Indonesian firm braves dizzying ride for global stock markets to kick off IPO

-

South and Southeast Asian bond issuers in focus amid jittery markets

-

Refinancing risks have now spread beyond China to other regional borrowers

-

The pricing to be offered are expected to be similar to pre-Covid levels

-

Ride-hailing, e-commerce group eyes $29bn valuation

-

-

GlobalCapital Asia's Best Investment Grade Syndicated Loan of 2021 is Indonesia Asahan Aluminimum's $1.5bn loan, split between a $750m five year term loan and $750m three year revolving credit facility.

-

For 2021, GlobalCapital Asia's winner of the Best Bond and Best SSA Bond awards is the Republic of Indonesia's $1.25bn and €500m SDG bonds with a concurrent tender offer of $1.25bn.

-

GlobalCapital Asia's 2021 winner of the Best High Yield Corporate Bond award is Pakuwon Jati's $300m 4.875% seven non-call four year bond.

-

The GlobalCapital Asia award for Best Investment Grade Corporate Bond for 2021 goes to Indofood CBP Sukses Makmur’s $1.75bn bond, split between a $1.15bn 3.398% 10 year and $600m 4.745% 30 year bond.