Indonesia

-

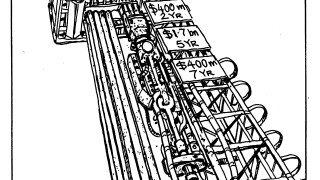

The sovereign takes $2.65bn from popular deal, and seals a concurrent tender offer

-

-

Ballooning NPLs and a convoluted bankruptcy regime need to be tackled quickly to ward off a bigger crisis

-

The deal offers a relatively low pricing, which could be challenging for potential lenders

-

S&P Global Ratings' move follows high refinancing risk on a $300m bond due next year

-

-

Appetite likely to be strong as lenders look to put their money to use in quiet market

-

The lender is planning capital raise for September

-

Borrowers find opportunities to manage balance sheets amid weak market conditions

-

Deal is split into dollar and local currency portions

-

Indonesian oil and gas major makes loan debut but would have to steer the deal through some sceptical lenders

-

The palm oil company had made its sustainability loan debut last year