Featured FIG

-

Market recovers from shaky start as smart pricing draws huge order books

-

Spreads gap out too fast after the credit rally of a lifetime ends, pushing price-sensitive issuers to reconsider their market entrance

-

LBBW and Commerzbank reserve their slots early for first trading day of 2024 with December mandate announcements

-

Banks may bring forward their 2024 funding plans to snap up duration as investors look to position ahead of predicted rate cuts

-

Issuance opportunities abound across capital stack but borrowers said to be happy to wait for deeper liquidity

-

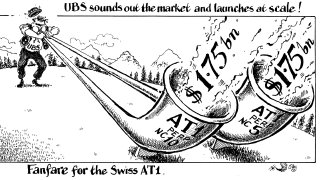

Investors pounce on Société Générale and UBS sales after yields rise, then rates rally to soothe fears

-

Banks have a promising but fleeting funding window that could push unsecured issuance for the year to a new record

-

Relieved market enjoys a rally, but weaker names are still out of favour

-

US banks may find a willing audience in euros but that will add to complications for European issuers as they look to start early on 2024 funding

-

Santander makes case for G-Sib issuance but bankers insist minnows can price unsecured too

-

Senior issuance to come to the fore as higher rates deter covered bonds and subordinated funding

-

Banks could be snared by higher reserve requirements, deposit flight and active quantitative tightening