Featured FIG

-

Lender expects to report a pre-tax loss of €210m-€265m by the end of 2025

-

Market participants spot first signs that ever improving funding conditions may be over

-

ESG deals show there is more to labels than just saving on spread

-

Issuers' desire to put covered pre-funding to one side suggests concerns over bumps ahead

-

The next leg of the spread convergence between eurozone periphery and core FIG issuers could come from the east or south

-

As the latest senior issuance sets new low in FIG euro spreads and call premiums evaporate at the long end, questions are being asked — how low is too low?

-

Deal opens door for more foreign FIG regulatory capital raising Down Under

-

'Great' market conditions are not immune to central bank surprises and fund inflow changes

-

Foreign investors show confidence in French assets, including innovative defence financing deal, as political concerns grow

-

Allianz's early dollar tier one foray paves the way for tight pricing

-

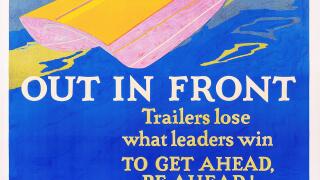

Issuers shift the primary market equilibrium in their favour but questions raised whether it can last

-

Senior funding there for the taking, covered bonds yet to take off — but conditions are great for all