Hungary

-

It can take years to prepare bonds in some markets, but that can bear fruit

-

Euro market does not offer the size or duration it used to

-

Hungarian bank's deal could be the last new issue from CEE until September

-

Investors not keen on CEE as liquidity drops heading into July

-

Recent deals from the likes of Unicaja will be a guide to pricing OTP

-

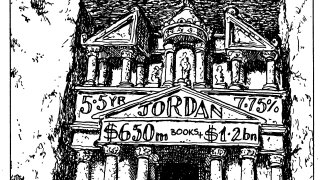

While some issuers took encouragement from Hungary’s and Jordan's deals, most buyers remain cautious

-

Issuer could come close to wrapping up 2022 funding despite investors' ESG concerns

-

Hungary joins CEE sovereign flurry

-

Fears over Ukraine did not deter Japanese investors

-

Ukraine invasion fears close EM primary bond market but niche deals can still go ahead

-

Four CEEMEA issuers are trying to issue new bonds, but investors are being put off by volatile US Treasury yields

-

Investors accept minimal concession from the airline, after piling into a bulging order book