HSBC

-

The bank’s rescue of the tech-focused lender is a logical step in the bank’s global push to embrace growth companies

-

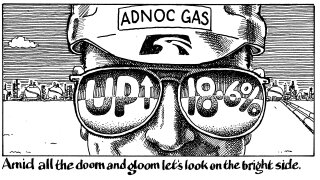

Biggest ever Abu Dhabi IPO defies jitters after SVB collapse

-

Issuers want a clear view of contagion risk from US bank collapse

-

High yield sell-off is weakening confidence

-

Brewing company eschews floating rate format for short maturity

-

The unusual tenor for the expected €6bn deal has left some bankers wondering

-

UK lender taps two points of the curve with popular deal, while rare issuers line up offers

-

The loan is not to finance takeover, but will refinance coming maturities

-

Demand was strong, but bankers concerned about flotation of Abraj, to be priced on Monday

-

-

A book by Cazenove’s former CEO charts the build-up and aftermath of the deal that made JP Morgan a force in UK investment banking. But the financial crisis proved to be the real catalyst for its subsequent dominance

-

UK lender crosses the Atlantic for first subordinated deal of the year