Haitong Securities

-

Dingdong (Cayman), a Chinese e-commerce company for fresh groceries, and its rival Missfresh are testing investor appetite at the same time for their US IPOs.

-

SCE Intelligent Commercial Management has hit the road with its Hong Kong IPO. It is looking to raise up to HK$2.3bn ($296.2m).

-

Chinese teahouse chain Nayuki Holdings opened the doors for its up to HK$5.1bn ($656.1m) listing on Friday.

-

Sino-Ocean Capital Holding has raised $500m from a two year bond. The deal was the company’s longest in the offshore market, but came with a weaker structure than its past outings.

-

Property manager Yuexiu Services Group has hit the road with an up to HK$2.41bn ($310.5m) IPO.

-

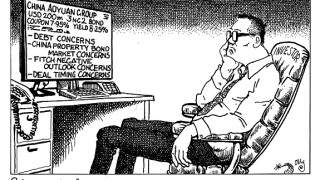

China Aoyuan Group’s attempt to woo investors to its $200m bond with a generous yield fell flat on Tuesday. Recent concerns about the property developer’s leverage, and the subsequent fall of its dollar bonds in the aftermarket, held investors back from the new deal — and caused a further spiral in secondary. Morgan Davis reports.

-

Chinese online recruitment company Kanzhun has hit the road with an up to $912m Nasdaq listing.

-

Two Chinese local government financing vehicles joined the flurry of dollar bonds in the Asia market on Thursday.

-

Two Chinese real estate companies sold sub-one year bonds on Thursday, raising $350m between them.

-

Zhenro Properties Group visited the offshore bond market for the fourth time in 2021 this week, adding another $340m to its coffers.

-

Two Chinese real estate borrowers, Agile Group Holdings and Datang Group Holdings, hit the dollar debt market on Monday.

-

Shandong Finance Investment Group Co sold its first dollar bond this week. Its $500m deal was heavily supported by a large syndicate team.