Goldman Sachs

-

German housing association arrives on strong Monday for IG corporates as A2A green also cruises through

-

Potential Covid-19 vaccine developer launches bookbuilding

-

US banks are raising huge amounts to fund balance sheet expansion during the pandemic

-

Ant-backed mobile wallet draws strong institutional demand

-

US corporate bond wave expected ahead of rate rises

-

Canadian borrowing looking for 50 year sterling debt

-

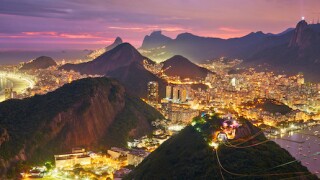

FX volatility could affect Rio Smart Lighting’s real-denominated deal

-

-

Country's stock exchange is set for a record year for listings

-

Burger King France, Tui and RAC lead charge into high yield market

-

Real estate sector is the most active in Europe’s high grade corporate market

-

Diabetes management device maker heads for listing on Hong Kong's main board