Goldman Sachs

-

More than $30bn raised as banks turn to primary market after quarterly earnings announced

-

GS appoints new co-heads of real estate banking

-

-

Goldman Sachs joins Western Europe's top three bookrunners

-

◆ Dollar basis working for euro issuers in five year ◆ Maturity working for issuers in 2025 ◆ Deals come a day before Trump tariff announcement

-

◆ First euro deal from Candian province hits 'perfect storm' ◆ BNG and AFD print 15 years ◆ All tighten by at least 3bp

-

Wendel received €750m of cash up front, about 86% of shares’ pre-trade value

-

◆ Talk of planned mandate change comes as bank raises €4bn ◆ More defence projects to become eligible for loans ◆ Deal not impacted, green label helped

-

◆ Sovereign sets new book and size records ◆ Deal a hit despite 'not straightforward' backdrop ◆ 'Different story' while still 'a confidence booster'

-

◆ Joint Länder trade raises €1bn ◆ JLMs help cover deal ◆ EGB sell-off deepens

-

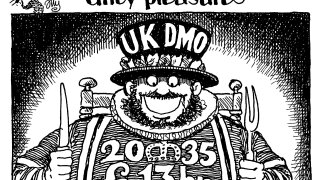

◆ Record book and deal size ◆ Investor demand 'at odds' with media headlines ◆ Key BoE actor clears up position

-

◆ NRW.Bank opens euro account ◆ WIBank flat to fair value ◆ Saxony-Anhalt tightens