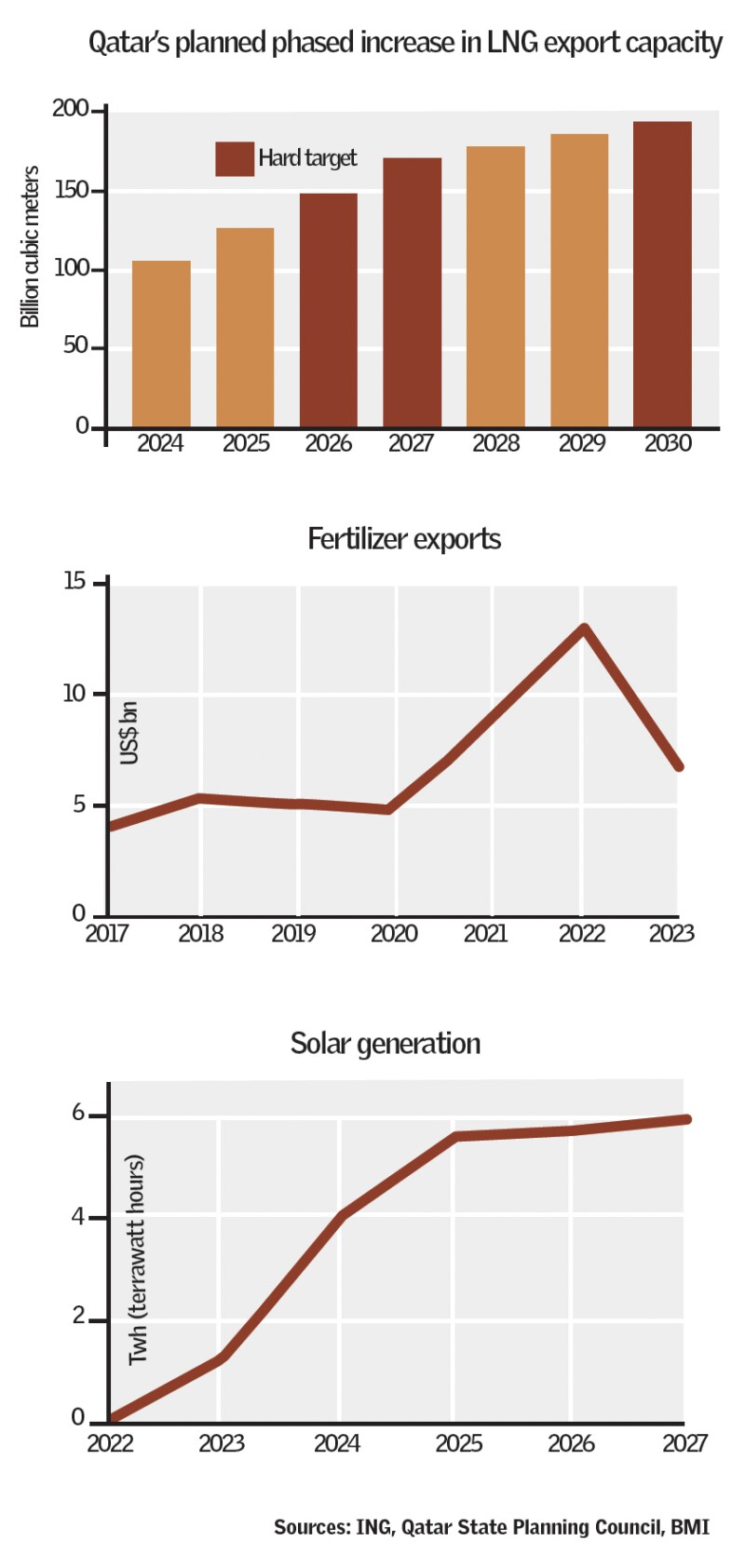

Qatar famously shares the world’s largest natural gas deposit — North Field — with Iran. That endowment helped make Qatar — at one stage — the world’s largest natural gas exporter. As the US and Australia have ramped up capacity over the last decade, Qatar has fallen to third. But it is unlikely to stay there. The country has begun a colossal phased increase of its production capacity. ING analysts say the phased increase will take Qatar’s export capacity from 105 billion cubic metres to 193bcm by 2030 — an increase of more than 80%.

If this goes as planned, Qatar could be the second largest supplier of liquefied natural gas by 2030 — accounting for close to 25% of global supply. “The oil and gas sector is poised for transformational growth,” says Abdulrahman bin Fahad bin Faisal Al Thani, chief executive officer of Doha Bank.

Over the very long term, Qatar faces carbon transition risk. The country is heavily reliant on polluting fossil fuels in a world that is increasingly filled with carbon taxes and other efforts designed to cut emissions. But in this new world LNG becomes more important — not less.

When Qatar first discovered its natural gas fields in the early 1970s, there was disappointment that the deposits were not crude oil. The authorities dragged their heels on developing the gas field, feeling that it was unlikely to be worthwhile. Fast forward 50 years and LNG is uniquely placed to act as a transition fuel for the world.

Estimates are that electricity produced from LNG has 30% lower emissions than that produced from crude oil and 45% lower than electricity produced in coal-fired plants.

Most of western Europe is well advanced in its efforts to phase out coal. But the twin giants of China and India are not. Over 50% of India’s installed electricity generation capacity is coal-based. In 2023, almost 60% of China’s electricity supply came from coal.

Europe, meanwhile, needs a replacement for the Russian natural gas it no longer wants to rely on. In late 2023, Qatar signed 27 year agreements to supply gas to Shell in the Netherlands and TotalEnergies in France — the largest and longest deals Qatar has signed with Europe.

Qatar may not be the world’s largest supplier of LNG, but it is the lowest cost producer.

It is also making major efforts to make its LNG production as low emission as possible. It has exported cargoes of certified net zero or carbon-neutral LNG, and buyers have been prepared to pay a premium.

There are different definitions and auditing processes for low carbon LNG — and there are critics of the very idea of calling LNG low-carbon. But in a world where lowering emissions wherever possible is a priority, Qatar’s ability to compete on price and emissions is an asset.

Petrochemicals power

The growth of Qatar’s oil and gas production has given birth to a thriving petrochemicals sector. BMI analysts point to the significant competitive advantage it enjoys because of Qatar’s low production costs for oil and gas.

The main constraint on how successful Qatar can be at growing its petrochemicals sector, they say, is the lack of diversity in its product range. It is heavily oriented towards high volume, low value ethylene-based products and fertiliser.

BMI analysts say the country has significant potential for new cracker facilities and opportunities to develop exports across the full value chain.

Qatar is well aware of its potential and is expanding its capacity rapidly. It is a major producer of naphtha, having signed major supply agreements with Japanese, South Korean and Indian firms.

QatarEnergy and Chevron Phillips Chemical are building a new $6bn production complex — the Ras Laffan Petrochemical Project. This will house the largest ethane cracker in the Middle East and one of the largest in the world. Ethane by-products are used in a wide range of products from plastics to pharmaceuticals. High density polyethylene derivative units will produce polyethylene for export and use in producing hard plastics.

Qatar’s cutting edge science institutes are using the country’s natural resources to develop new solutions for sectors with hard-to-abate emissions, like aviation. Qatar Airways is sponsoring research into sustainable aviation fuel. It aims to use SAF for 10% of its combined fuel volume by 2030, and recently signed a deal with Shell to source 3,000 metric tonnes of neat SAF for its flights at Amsterdam.

Blue or green?

Major projects have broken ground in other areas. QatarEnergy Renewable Solutions and Qatar Fertiliser Co (QAFCO), both affiliates of QatarEnergy, are building the world’s largest blue ammonia facility — the Ammonia-7 project.

Almost 190m tonnes of fossil fuel-based ammonia are used each year — the great majority of it to produce fertiliser. Estimates are that this ‘grey’ ammonia accounts for around 2% of the world’s CO2 emissions.

To remedy this, all the world’s ammonia production needs to become clean. Blue ammonia — produced from fossil sources with almost complete carbon capture and permanent storage (CCS) — is one solution.

Green ammonia — produced by electrolysis powered entirely by renewables — would be even cleaner. But the problem is price — blue ammonia is going to be far cheaper than green.

Its cost makes demand far stronger for blue ammonia than green, across a range of use cases.

One of them is as a shipping fuel. A recent EU-funded study by consultancy DNV estimates that the shipping industry’s demand for clean ammonia will soar from 2.3m tonnes a year in 2030 to 62m in 2040 and 245m in 2050. Of that, DNV thinks over 75% will be blue ammonia. If it is right, Qatar is positioning itself to become a leading producer of the global maritime fuel of choice.

CCS is not a straightforward endevour, but Qatar is one of the few countries with the finances, incentives and state-directed coordination to make it work.

The country has a carbon capture roadmap, and wants to store over 11m tonnes of CO2 a year by 2035. New CCS plants under construction will capture emissions from Qatar’s LNG trains and compress it for injection into already available wells.

Renewables ramp up

Qatar’s oil and gas deposits can help it provide the world with a valuable transition fuel — LNG — and potentially cutting edge fuels of the future like blue ammonia.

But gas, although a cleaner fossil fuel than coal and oil, will not help the country achieve its carbon emissions reduction targets, says Carole Nakhle, founder and CEO of advisory firm Crystol Energy. “It is difficult for a country which sits on massive and cheap natural gas resources to look for alternatives,” she says. “That said, given the wealth that Qatar has accumulated as a result of its gas trade, that small but very rich country can easily afford to invest in green energy to achieve its climate ambitions — a privilege that not many countries have.”

Recognising the need to pursue non-fossil fuel-based energy, Qatar has developed a National Renewable Energy Strategy.

Al Thani at Doha Bank frames the strategy as aiming to increase the use of renewable electricity, alongside low cost natural gas-fired electricity generation, to improve the quality of life for present and future generations. There is an explicit target to increase utility-scale integrated renewable power generation to 4GW by 2030.

“As the world shifts toward sustainable energy solutions, we expect significant advancements in this sector in Qatar,” says Bassel Gamal, chief executive of QIB. “The focus on renewable energy sources is becoming increasingly critical, driven by both global trends and national objectives. QIB is committed to investing in sustainable energy projects, providing financial support for initiatives that align with our environmental goals and contribute to a greener future for the region.”

Solar dawn

When it comes to actually rolling out renewable power, Qatar has perhaps been slower than some of its neighbours like the United Arab Emirates and Saudi Arabia. But the pace at which Qatar adds green energy to the grid is accelerating. BMI analysts expect solar to account for 60% of the total net growth in Qatar’s electricity generating capacity between 2023 and 2033.

Competitive tenders for large projects with defined land area and a reliable grid connection make projects straightforward for developers. Qatar has succeeded in attracting extremely competitive bids and strong interest from a wide range of developers — local and international — that further drives down costs.

Besides grid-scale generation, the country has kicked off multiple solar power projects including solar-powered desalination and manufacturing facilities. “Qatar has really speeded up,” says Robin Mills, CEO at advisory firm Qamar Energy. “There’s been significant acceleration on the solar power side.”

Qatar has also shown savvy restraint when it comes to some of the newer and less proven technologies. Saudi Arabia, the UAE and Oman are all vigorously pursuing green hydrogen.

But there are serious questions over to what extent green hydrogen can be produced at prices low enough to justify the various use cases — from an alternative fuel in power plants to a home heating solution. Various European countries have been scaling back their green hydrogen plans, as the true complexity and cost become clear.

“[Qatar] has been a lot more limited in its ambitions, but you could also say more focussed,” says Mills. This includes making its LNG as low carbon as possible, using it to create blue hydrogen and blue ammonia through carbon capture and tapping its enormous solar potential.

“Qatar has a few clear areas where they are quite decisive about where they think they have an advantage,” he says. “That’s the advantage of being a smaller country, they don’t have to do everything.”