GCC

-

Existing shareholders and sector specialists keen on shares in German carmakers

-

Big demand for UAE deal as IPO issuance from the Middle East overtakes Europe once again

-

Shareholder's reputations may be hurt, but their debt market access will not be affected

-

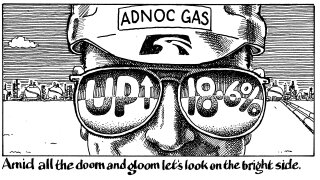

Adnoc Gas and Abraj Energy surge in early trading as global equities plummet

-

Currency exchange house secures $54m cornerstone bid from National Bonds Corp

-

OQ's oil drilling unit was Oman's biggest listing since 2010

-

Biggest ever Abu Dhabi IPO defies jitters after SVB collapse

-

The UAE exchange house could aim for a valuation of up to $2.75bn, market sources suggest

-

The lender offered investors a spread of nearly 200bp to the Emirate of Sharjah, said a lead bank

-

Development bank's triple-A ratings mean GCC's sovereigns and banks will learn little from its sukuk

-

Demand was strong, but bankers concerned about flotation of Abraj, to be priced on Monday

-

Investors show strong demand for first big deal in the region this year while markets enjoy respite from boom