GCC

-

Without an IMF deal Tunisia will struggle to get any more funding from bilateral partners

-

An Abu Dhabi investment firm has committed to $8.5bn of earthquake relief bonds

-

Dar Al Arkan, a speculative grade issuer, hit the top end of its size target

-

Investors may be tiring of GCC real estate issuance but borrower is a familiar face

-

-

The clean energy firm attracted orders over $3.7bn by midday in London

-

The main comparables will be bonds from its shareholders such as Taqa and Mubadala

-

Lower than expected inflation in the US has given EM issuers a boost heading into summer

-

Real estate firm eyes the market after a week of US Treasury yield yo-yoing

-

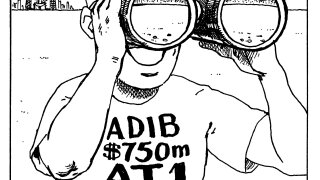

Despite ADIB's success, many EM issuers will be unable to refinance their AT1 bonds

-

The real estate firm broke new ground in the GCC by inserting a call option

-

Deal from UAE real estate developer is scheduled for next week