Finland

-

Sizeable euro funding to supplement domestic deals across the Nordic region as Swedish domestic advantage ebbs

-

‘Tactical’ niche currency deals to supplement increased benchmark funding

-

Sanoma has syndicated a €300m revolving credit facility and €250m acquisition term loan

-

Finnish agency calls in on euros, knocks on Nokkie and floats into dollars

-

Upcoming deals to test the curve from two years out to nine

-

Government issuers may need to be ready to pay up, say market participants

-

Nordic sovereign presents investors with 'untested water'

-

Pair follow bigger borrowers' lead in announcing dollar bond mandates

-

Widening in local currency benchmark covered bonds makes new domestic issuance unattractive

-

Meeting MREL targets and topping up on subordinated debt issuance to drive the largest Nordic banks' funding plans

-

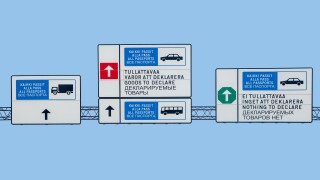

Russia neighbour cruises through busy sovereign market that also hosts France linker

-

Innovative market turns to supply chains, biodiversity and asset-heavy companies