Top section

Top section

◆ Insurance companies anchor long dated green tranche with near-4% yield ◆ Curve extension debated ◆ Deal comes amid widening secondary spreads but lands with negligible premium

◆ UK lender raises $4.5bn-equivalent in five senior holding company tranches this week ◆ Both deals target long dated funding ◆ Despite secondary widening, euro offering lands with hardly any premium

◆ 52bp reoffer equals Nordea’s multi-year record ◆ ‘Insane’ levels show FIG spread compression, rival banker said ◆ Buy-and-hold investors prioritised

Data

Favourable market conditions have made raising debt like 'fishing with dynamite' for bank issuers. But concerns are mounting about volatility ahead

French bank scoops top spot overall, while BNP Paribas leads in senior and Crédit Agricole in capital

Strong demand and tight spreads has propelled volumes past January records

Late-week surge shows investors remain hungry for paper despite macro volatility

More articles/Bond Comments/Ad

More articles/Bond Comments/Ad

More articles

-

Credit spreads widen on private credit concerns though technicals remain favourable

-

Domestic issuers return this week, with Pfandbriefzentrale scaling liquidity via covered bonds

-

◆ Holders win write-down ruling but path to recovery uncertain ◆ StrideUp brings Islamic innovation to UK securitization ◆ Emerging market bonds have an off-week (almost)

-

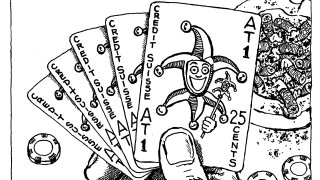

Credit Suisse AT1 bondholders should consider alternatives after this week's sharp repricing

-

Claims on Credit Suisse AT1 bonds shot up after a court ruling this week, though a long judicial process is anticipated

-

Growing awareness and understanding of Sharia-compliant loans expected to ramp up originations

Polls and awards

The covered bond market gathered in Seville to celebrate its standout deals, institutions and individuals

Last chance to vote for the best winning deals, individuals and organisations in the covered bond market

The leading banks, issuers, individuals and other market players were named at GlobalCapital's flagship industry dinner in London

The winning deals and organisations will be revealed at our gala dinner in Seville on September 18

Sub-sections

Comment