Top Section/Ad

Top Section/Ad

Most recent

◆ Italian bank increased benchmark size to €750m ◆ Deal expected to perform in secondary ◆ Covered was one of two issued on Thursday

◆ Canadian bank lands tightest euro covered this year ◆ Further Canadian issuance on the day ◆ Banker on the deal said tranches were priced just inside fair value

◆ Austrian bank's first covered in nearly two years ◆ Both tranches offered 5bp of NIP says banker ◆ Modest 3bp tightening reflects 'normalisation' of covered market

◆ German bank secured spread tightening across tranches◆ Banker said first tranche offered small NIP but second had nothing ◆ Tuesday’s deals failed to deliver the spectacular order books of last week

More articles/Ad

More articles/Ad

More articles

-

◆ Deal demand shows covered bonds ability to withstand volatility ◆ No concession needed ◆ French deal lands through OATs

-

◆ Deal lands flat to Pfandbriefe ◆ No premium paid ◆ Slim spread gap to SSAs

-

◆ Swedish issuer starts tight ◆ Deal lands close to recent SSA supply ◆ Seven year tenor offers investors something different

-

◆ Note lands close to national champion ◆ Issuer targeted price over size ◆ Deal shows Fridays are an open window

-

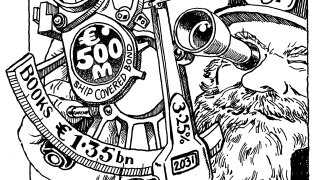

Issuer plans regular voyages to euro covered market

-

◆ Investors flock to tightly priced trade ◆ Next to no premium paid ◆ Sparebanken Vest is still to come