Top Section/Ad

Top Section/Ad

Most recent

◆ Italian bank increased benchmark size to €750m ◆ Deal expected to perform in secondary ◆ Covered was one of two issued on Thursday

◆ Canadian bank lands tightest euro covered this year ◆ Further Canadian issuance on the day ◆ Banker on the deal said tranches were priced just inside fair value

◆ Austrian bank's first covered in nearly two years ◆ Both tranches offered 5bp of NIP says banker ◆ Modest 3bp tightening reflects 'normalisation' of covered market

◆ German bank secured spread tightening across tranches◆ Banker said first tranche offered small NIP but second had nothing ◆ Tuesday’s deals failed to deliver the spectacular order books of last week

More articles/Ad

More articles/Ad

More articles

-

◆ Issuer happy to print more at tight price ◆ Single digit premium paid ◆ Australian covered spreads hold firm

-

The awards recognise the market's leading deals, issuers, banks and other participants

-

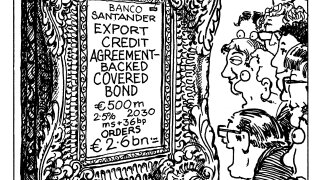

◆ Bond secured against a pool of export credit agreements ◆ Santander gets biggest bid-to-cover ratio since March ◆ Deal lands flat, if not through, fair value

-

◆ Small books do not mean small deals ◆ Norwegian trade lands tight to Pfandbriefe ◆ Next to no premium paid

-

◆ Deal is the first Austrian benchmark since January ◆ Slim premium paid ◆ Austrian supply down due to lower loan growth

-

◆ Less frequent and smaller Europeans return after Iccrea reopening ◆ Latest sub-benchmark Austrian deal adds issuer diversity ◆ CCF meets annual funding need