Top Section/Ad

Top Section/Ad

Most recent

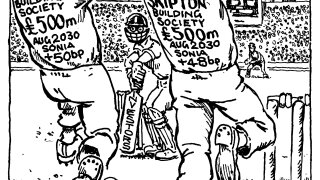

Covered bond redemptions are set to increase by €20bn next year and €30bn in 2027

Strong demand for slim supply could tempt issuers to access the market before Christmas

No investors involved in Caffil's latest deal mentioned concerns over French risk

Issuers' desire to put covered pre-funding to one side suggests concerns over bumps ahead

More articles/Ad

More articles/Ad

More articles

-

Demand supported by resurgent asset manager bid

-

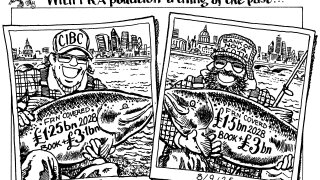

Market participants hope more jurisdictions will follow as Canadian duo attract record demand

-

Paper could arrive on Monday or Tuesday, ahead of flagship covered market event

-

Banks, corporates, even the government find eager buyers

-

Slim premiums and big price tightenings achieved

-

Lower than expected issuance volume to keep covered spreads tight into the autumn