Euro

-

Recent Länder trades shed some light on primary market for covered bonds

-

◆ Second German state braves this week's volatility ◆ 2bp NIP is ‘fair enough’ for Länder ◆ ‘Important to keep market open’ and encourage others, say bankers

-

Markets roil as investors try to decipher if issuance will bounce back or slowly return

-

'Not much supply in immediate future' as volatility cripples issuance

-

◆ Issuer steps on the accelerator to price fast ◆ ‘Lengthy’ discussion and ‘a lot of thought’ given to timing, pricing strategy ◆ Higher NIP and limited tightening encourage investors

-

Banks could get stuck with large exposures they cannot offload

-

Rates investors show they’re still keen, sparking hopes credit buyers are too

-

IG lending fees tipped to stay tight despite some leveraged loans being postponed

-

A covered bond deal a possibility and spreads recover slightly but little incentive for most deals after 'wild' morning

-

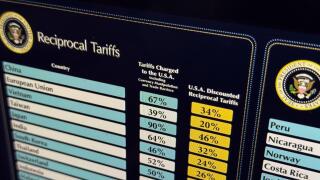

Bloc to test investor sentiment in primary as financial markets struggle to digest US tariffs

-

Supply could quickly resume if conditions stabilise

-

As markets gap wider, the ability to get a deal done at all is commendable