Euro

-

◆ Investors eager to buy capital from big and smaller banks ◆ Bankinter places largest AT1 at reset under 400bp ◆ Much smaller Optima bank from Greece also debuts

-

◆ Deal is Achmea's second in five weeks ◆ Investors eager to pick up no-grow deal ◆ Small premium left for performance

-

◆ Trade is Polish bank's first in euros for three years ◆ Proceeds to fund upcoming maturity ◆ Periphery and non-eurozone deals used for pricing

-

◆ Hyundai’s US arm drums up blowout response in euros ◆ Telefónica rings in solid trade ◆ SEB proves unrated spreads can be modest

-

◆ Speculative interest anticipated ◆ Geopolitical tensions make little dent ◆ 15 year sweet spot for Dutch pension funds

-

White House mis-steps have raised hopes the euro can supplant the dollar

-

◆ Italian bank prints €1bn in first tier two since January 2024 ◆ Demand for higher yielding deals outweighs Middle East escalation ◆ Other new financial issuers of capital line up deals

-

◆ Deal attracts strong real money demand ◆ Minimal drops as accounts stick with price move ◆ Low single digit premium needed

-

◆ Hybrids fight for attention alongside SLBs and green bonds ◆ Books remain well subscribed ◆ But pressure is building for market sentiment to sharply turn

-

Black Sea Trade and Development Bank treasurer explains why now was the right time to return to raising debt

-

◆ Scarcity value draws buyers ◆ Nordic investors lured by big pickup against krona ◆ Bankers debate euro or dollar for next international bond

-

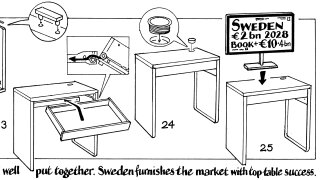

Borrower monitoring market windows ahead of novel European sovereign sustainability-linked bond