Euro

-

The wealth fund hopes to secure a funding arbitrage compared to dollars

-

◆ Italian masts company increases seven year deal ◆ Orders sticky during bookbuild ◆ Low single digit premium

-

◆ Engie draws strong demand despite more chaos in French government ◆ Deal lands at or through fair value ◆ Eurogrid joins EuGB cohort with €1.1bn deal

-

◆ Issuer prints new green bond as French government teeters on collapse ◆ Deal comes tighter than shorter SNP green bond from March ◆ Latest trade in a recent Nordic senior series

-

◆ Canadian lender sticks to the plan despite rates volatility ◆ Deal lands close to fair value ◆ Tenor chosen to avoid comparison with Aussies

-

◆ New investors after European roadshows ◆ Issuer receives 'a lot of attention' from dealers ◆ Achieving liquidity and competitive pricing in swaps important

-

◆ Demand falls as deal prices flat to fair value ◆ Quality sticks despite tight price ◆ Euros 'more efficient' than sterling

-

Green loans and project financing needed for Europe-wide rollout

-

As the latest senior issuance sets new low in FIG euro spreads and call premiums evaporate at the long end, questions are being asked — how low is too low?

-

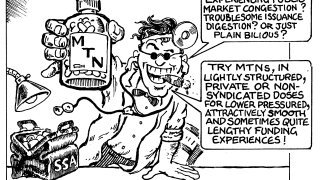

European sovereign pair showcased the value of the MTN market

-

Issuer eyes €160bn funding next year as SAFE programme starts, but could even more funding be required?

-

FIG supply clustered at the front end with a flurry of floaters